Short Term Multifamily Financing

Get the Financing You Need for Your Apartment Buildings

From brownstones to high-end luxury apartments, Leg Up Capital offers accessible financing for everything from acquisitions to refinancing and cash-outs. Out short-term multifamily financing features:

- Loan amounts from $250K to $10M ($1M max per unit with a minimum value of $30K per unit, adjustable per location)

- Terms up to 18 months

- Minimum credit score of 650 to qualify

For Stabilized Bridge Financing

- Up to 75% of the as-is value for purchases

- Up to 70% of the as-is value for refinancing

- Up to 65% of the as-is value for cash-out

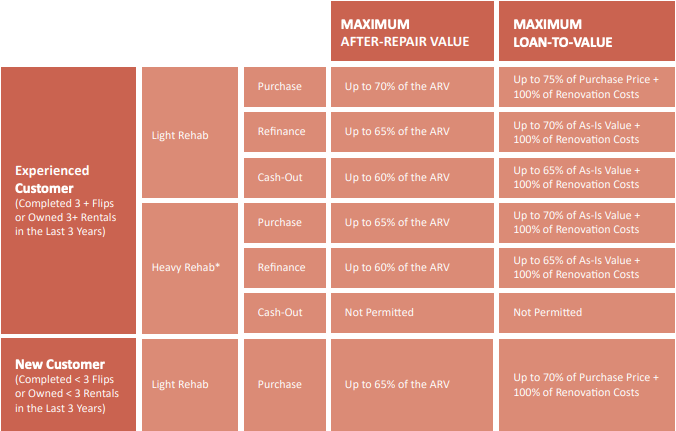

For Fix and Flip Projects:

- Up to 75% of purchase plus 100% of rehab for acquisitions

- Up to 70% of as-is value plus 100% of rehab for refinancing

- Up to 65% of as-is value plus 100% of rehab for cash-out

Short-term multifamily financing from Leg Up Capital uses the following property types for collateral:

- Multifamily apartment buildings (5+ units)

- Mixed-use (residential space greater than 50% of the total square footage)

Contact Us

If you need short-term financing for a multifamily property, contact the team at Leg Up Capital today by filling out the form above.